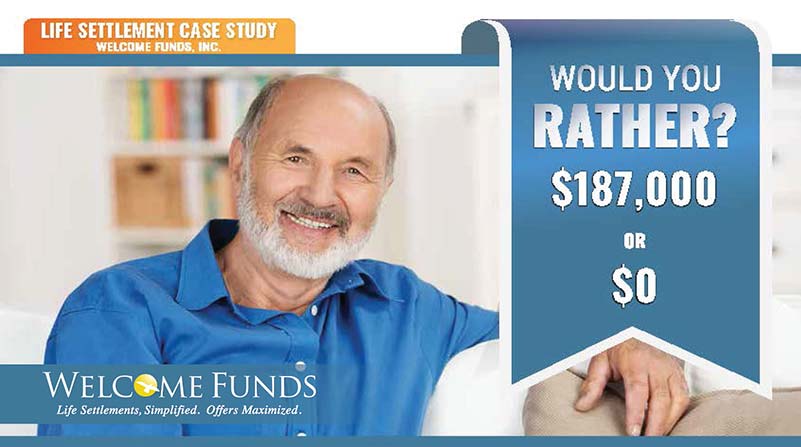

How to Sell Your Life Insurance Policy for $187,000 Instead of $0!

Posted: April 06, 2021 by John Welcom

A small business was filing for bankruptcy and its assets were being reviewed. The company’s financial advisor helped the partners identify the value, which they did not know existed, contained in its key man life insurance coverage.

Welcome Funds Represents Your Best Interests!

A small business was filing for bankruptcy and its assets were being reviewed. The company’s financial advisor helped the partners identify the value, which they did not know existed, contained in its key man life insurance coverage. The advisor recommended that Welcome Funds appraise the policy. The business decided to maintain the coverage so that the policy could be sold as a life settlement, instead of letting it lapse for $0. The proceeds from the sale paid off creditors and finalized the bankruptcy settlement. The partners were able to address their much needed liquidity needs and move on with their lives.

| Policy's Insured | Male | Age 77 |

| Health Status | Fair |

| Policy Type | Universal Life |

| Face Amount | $1,500,000 |

| Annual Premium | $74,000 |

| Surrender Value | $0 |

Life Settlement Payout.... $187,000

Click here to download: Jack's Life Settlement Case Study

Recent Blogs

The Importance of Privacy & Confidentiality in the Life Settlement Industry

Posted: February 28, 2025 by John Welcom

Learn how privacy and confidentiality are safeguarded in life settlements. Discover regulatory protections, compliance standards, and why working with a licensed broker like Welcome Funds en...

Year-End Review for Advising Seniors: Helping Seniors Navigate 2025

Posted: December 09, 2024 by John Welcom

Working with Welcome Funds, a licensed life settlement broker, ensures maximum payouts for policyholders. Detailed case studies reveal how their auction-based strategy and expertise secure s...

DOL Fiduciary Rule Compliance: Life Insurance Sales and Fair Market Value

Posted: October 28, 2024 by John Welcom

The DOL's new fiduciary rule emphasizes advisors acting in clients' best interests. Learn why exploring life settlements is crucial for maximizing the value of life insurance policies.

877.227.4484

877.227.4484