How to Get the Highest Life Settlement Offer

Posted: March 16, 2020 by John Welcom

When you decide to sell a valuable personal asset, you usually want to obtain the highest purchase price for that property. It is sound business sense. However, how do you truly know when you have reached the point of accepting and securing the most desirable offer?

When you decide to sell a valuable personal asset, you usually want to obtain the highest purchase price for that property. It is sound business sense. However, how do you truly know when you have reached the point of accepting and securing the most desirable offer?

The only true way to feel confident that you have obtained top market value for your property is to rely on a proven platform that other people, just like you, have used to obtain the best price for a similar asset. For example, if you decide to sell your house, you are likely to hire a professional real estate agent who has knowledge of your market and has successfully handled the sale of similar houses for other homeowners in your community. Would you accept the first offer you receive from someone who called you immediately after listing your home or putting a “for sale” sign in your front yard? Of course, you wouldn’t. You would rather have the broker implement his or her proven platform for marketing your house to prospective buyers, lead the negotiations related to any offers and help you secure the most attractive deal for your family.

The same logic applies to sell your life insurance that you no longer need or can afford. A life insurance policy is an important personal asset that can have tremendous value in the secondary market. However, there is no way to know that you are maximizing the sale of a policy unless you rely on a proven brokerage platform.

The Role of the Life Settlement Broker

Experienced life settlement brokers help you navigate the secondary market for life insurance and connect you to the most qualified buyers who may be interested in purchasing your life insurance policy. When you work with a licensed life settlement broker, you know that your broker represents you and you alone, and has a responsibility to abide by your instructions and act in your best interest.

Each brokerage firm has its own operational tendencies and methodologies. Therefore, it is important to work with a company that has a long track record of success in the industry and can cite case studies where it marketed and sold policies similar to your life insurance policy. For example, Welcome Funds has been working with consumers and their trusted financial advisors for two decades and has negotiated more than 33,000 life settlement offers for life insurance policies of all types and sizes.

The most experienced life settlement brokers will already be familiar and have strong relationships with the leading buyers in the marketplace. This familiarity includes the varying interests of each buyer, the different objectives of investors in the industry, and the price ranges offered for various life insurance policies.

The fairest and best way to promote a life insurance policy to the secondary market is to manage a disciplined auction process. Welcome Funds invites state-licensed life settlement “providers” – the term used to describe buyers - to submit an offer for what they would be willing to pay for the life insurance policy. The auction model ensures that we obtain competitive, highest bids for your life insurance policy.

The Life Settlement Broker Platform in Action

Our proven life settlement brokerage platform is as simple as it is powerful. Our team starts by informing each licensed and qualified prospective buyer that we are representing a client who is seeking to explore the sale of his or her life insurance policy. Based on our experience and our proprietary software, we already have a good idea of the potential value of that life insurance policy on the market. Just as each client is unique, so is each life insurance policy that we review. We disclose the appropriate amount of information to the buyers so they can evaluate the life insurance policy and determine whether they wish to participate in our auction process.

The auction begins with the first round of bids, which we quickly evaluate and then issue recommendations to the client about how to proceed. We then continue with successive rounds of competitive bidding as long as necessary to identify the maximum sale price for the life insurance policy.

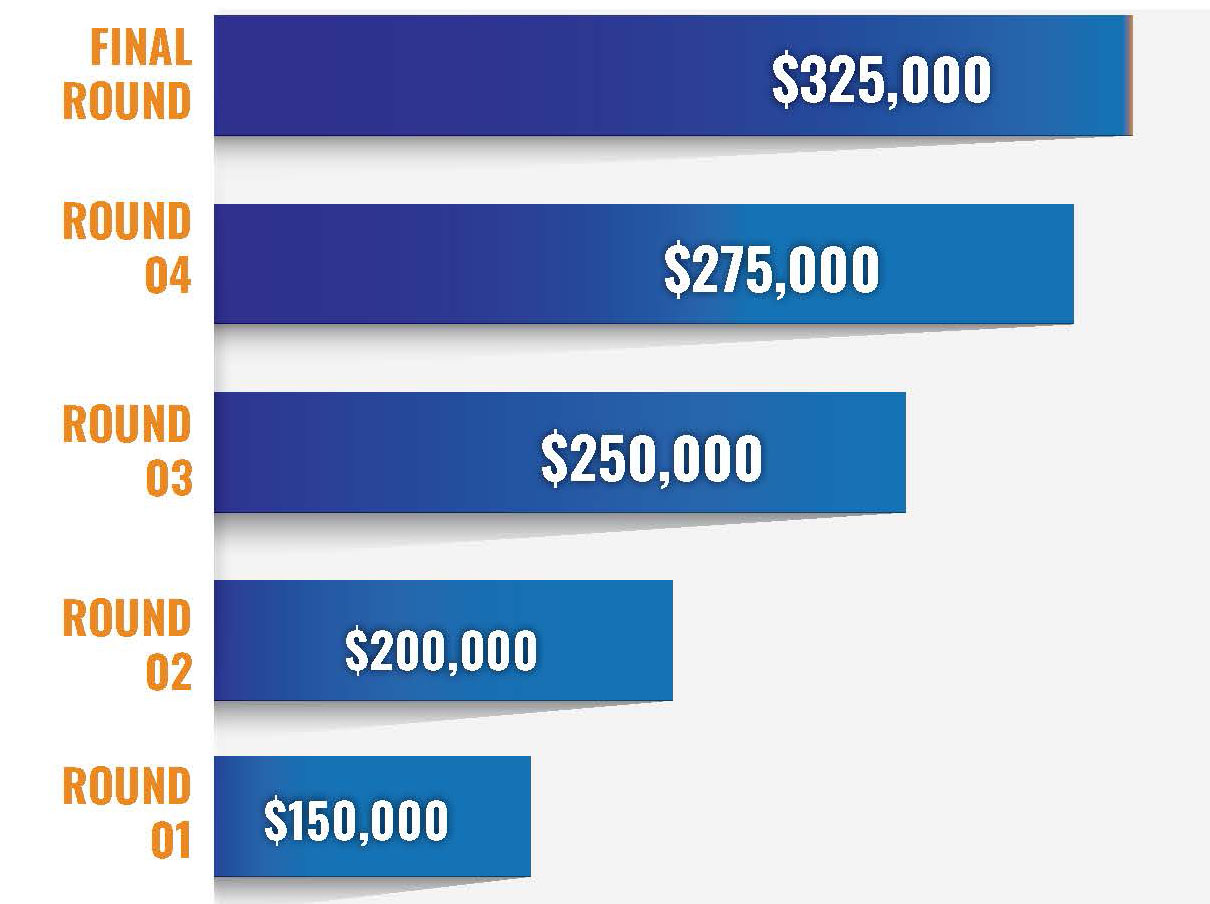

Please find below an example of one recent auction we managed for a policy with a face value of $1,250,000:

It is important to note that the final sale price for this life insurance policy was more than double the amount of the highest bid we obtained in Round 1, which was already a higher offer than the client would have received if he would have spoken to only one potential buyer. Therefore, even after our deducting our competitive brokerage fees, the client obtained hundreds of thousands of dollars more by selling his life insurance policy through our auction process. We experience this type of powerful results virtually every day.

There is Only One Way to Maximize Value

A buyer has no incentive to offer its highest price to you when it knows you are not marketing your asset to anyone else. Its objective is to secure high returns for its investors. So what should you do to protect yourself? Use a proven life settlement brokerage platform, managed by an experienced licensed broker, to maximize the true market value of a life insurance policy.

For more information, please visit www.welcomefunds.com or call 877.227.4484.

Click here to download: How to Get the Highest Life Settlement Offer

Recent Blogs

The Importance of Privacy & Confidentiality in the Life Settlement Industry

Posted: February 28, 2025 by John Welcom

Learn how privacy and confidentiality are safeguarded in life settlements. Discover regulatory protections, compliance standards, and why working with a licensed broker like Welcome Funds en...

Year-End Review for Advising Seniors: Helping Seniors Navigate 2025

Posted: December 09, 2024 by John Welcom

Working with Welcome Funds, a licensed life settlement broker, ensures maximum payouts for policyholders. Detailed case studies reveal how their auction-based strategy and expertise secure s...

DOL Fiduciary Rule Compliance: Life Insurance Sales and Fair Market Value

Posted: October 28, 2024 by John Welcom

The DOL's new fiduciary rule emphasizes advisors acting in clients' best interests. Learn why exploring life settlements is crucial for maximizing the value of life insurance policies.

877.227.4484

877.227.4484