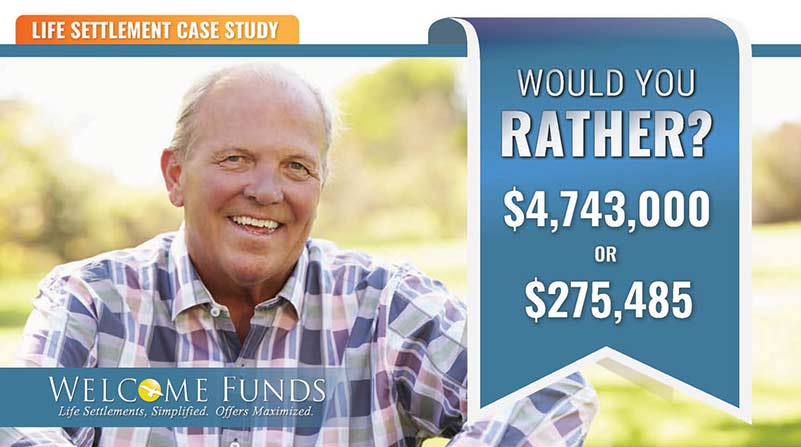

How to Sell Your Life Insurance Policy for $4,743,000 Instead of $275,485?

Posted: January 15, 2020 by John Welcom

Mr. Williams purchased $10 Million in life insurance coverage in 2001 to provide his family with financial security. Over time, his financial priorities changed: his wife passed away, his children became financially independent, financial burdens arose and the estate tax exemption increased substantially.

A Life Settlement is a Better Choice!

Mr. Williams purchased $10 Million in life insurance coverage in 2001 to provide his family with financial security. Over time, his financial priorities changed: his wife passed away, his children became financially independent, financial burdens arose and the estate tax exemption increased substantially. Therefore, the coverage was no longer needed and surrender was being considered. Fortunately, his advisor was aware of a more beneficial exit strategy, the ability to sell life insurance policies in a regulated secondary market. He presented Mr. Williams with a pre-market policy valuation report from Welcome Funds that estimated the market value to be substantially higher than the $275,485 surrender value. They were both shocked at the difference. Although Mr. Williams had never heard of a life settlement, he embraced the process, and well, the result – a difference of $4,467,515 - speaks for itself!

| Policy's Insured | Male | Age 86 |

| Health Status | Heart Disease |

| Policy Type | Universal Life |

| Face Amount | $10,000,000 |

| Annual Premium | $445,114 |

| Surrender Value | $275,458 |

Life Settlement Payout.... $4,743,000

Click here to download: Mr. William's Life Settlement Case Study

Recent Blogs

The Importance of Privacy & Confidentiality in the Life Settlement Industry

Posted: February 28, 2025 by John Welcom

Learn how privacy and confidentiality are safeguarded in life settlements. Discover regulatory protections, compliance standards, and why working with a licensed broker like Welcome Funds en...

Year-End Review for Advising Seniors: Helping Seniors Navigate 2025

Posted: December 09, 2024 by John Welcom

Working with Welcome Funds, a licensed life settlement broker, ensures maximum payouts for policyholders. Detailed case studies reveal how their auction-based strategy and expertise secure s...

DOL Fiduciary Rule Compliance: Life Insurance Sales and Fair Market Value

Posted: October 28, 2024 by John Welcom

The DOL's new fiduciary rule emphasizes advisors acting in clients' best interests. Learn why exploring life settlements is crucial for maximizing the value of life insurance policies.

877.227.4484

877.227.4484